7 Composing choices¶

It’s time to put everything you’ve learnt so far together into a complete and secure DAML model for asset issuance, management, transfer, and trading. This application will have capabilities similar to the one in IOU Quickstart Tutorial. In the process you will learn about a few more concepts:

- DAML projects, packages and modules

- Composition of transactions

- Observers and stakeholders

- DAML’s execution model

- Privacy

The model in this section is not a single DAML file, but a DAML project consisting of several files that depend on each other.

DAML projects¶

DAML is organized in packages and modules. A DAML project is specified using a single daml.yaml file, and compiles into a package. Each DAML file within a project becomes a DAML module. You can start a new project with a skeleton structure using daml new project_name in the terminal.

Each DAML project has a main source file, which is the entry point for the compiler. A common pattern is to have a main file called LibraryModules.daml, which simply lists all the other modules to include.

A minimal project would contain just two files: daml.yaml and daml/LibraryModules.daml. Take a look at the daml.yaml for this project:

sdk-version: __VERSION__

name: __PROJECT_NAME__

source: daml/LibraryModules.daml

version: 1.0.0

dependencies:

- daml-prim

- daml-stdlib

sandbox-options:

- --wall-clock-time

You can generally set name and version freely to describe your project. dependencies lists package dependencies: you should always include daml-prim, and daml-stdlib gives access to the DAML standard library.

You compile a DAML project by running daml build from the project root directory. This creates a dar package in dist/project_name.dar. A dar file is DAML’s equivalent of a JAR file in Java: it’s the artifact that gets deployed to a ledger to load the contract model.

Project structure¶

This project contains an asset holding model for transferrable, fungible assets and a separate trade workflow. The templates are structured in three modules: Intro.Asset, Intro.Asset.Role, and Intro.Asset.Trade.

In addition, there are tests in modules Test.Intro.Asset, Test.Intro.Asset.Role, and Test.Intro.Asset.Trade.

All but the last .-separated segment in module names correspond to paths, and the last one to a file name. The folder structure therefore looks like this:

.

├── daml

│ ├── Intro

│ │ ├── Asset

│ │ │ ├── Role.daml

│ │ │ └── Trade.daml

│ │ └── Asset.daml

│ ├── LibraryModules.daml

│ └── Test

│ └── Intro

│ ├── Asset

│ │ ├── Role.daml

│ │ └── Trade.daml

│ └── Asset.daml

└── daml.yaml

Each file contains the DAML pragma and module header. For example, daml/Intro/Asset/Role.daml:

module Intro.Asset.Role where

You can import one module into another using the import keyword. The LibraryModules module imports all six modules:

import Intro.Asset ()

import Intro.Asset.Role ()

import Intro.Asset.Trade ()

import Test.Intro.Asset ()

import Test.Intro.Asset.Role ()

import Test.Intro.Asset.Trade ()

Imports always have to appear just below the module declaration. The () behind each import above is optional, and lets you only import selected names.

In this case, it suppresses an “unused import” warning. LibraryModules is not actually using any of the imports in LibraryModules. The () tells the compiler that this is intentional.

A more typical import statement is import Intro.Asset as found in Test.Intro.Asset.

Project overview¶

The project both changes and adds to the Iou model presented in 6 Parties and authority:

Assets are fungible in the sense that they have

MergeandSplitchoices that allow theownerto manage their holdings.Transfer proposals now need the authorities of both

issuerandnewOwnerto accept. This makesAssetsafer thanIoufrom the issuer’s point of view.With the

Ioumodel, anissuercould end up owing cash to anyone as transfers were authorized by justownerandnewOwner. In this project, only parties having anAssetHoldercontract can end up owning assets. This allows theissuerto determine which parties may own their assets.The

Tradetemplate adds a swap of two assets to the model.

Composed choices and scenarios¶

This project showcases how you can put the Update and Scenario actions you learnt about in 6 Parties and authority to good use. For example, the Merge and Split choices each perform several actions in their consequences.

- Two create actions in case of

Split - One create and one archive action in case of

Merge

Split

: SplitResult

with

splitQuantity : Decimal

do

splitAsset <- create this with

quantity = splitQuantity

remainder <- create this with

quantity = quantity - splitQuantity

return SplitResult with

splitAsset

remainder

Merge

: ContractId Asset

with

otherCid : ContractId Asset

do

other <- fetch otherCid

assertMsg

"Merge failed: issuer does not match"

(issuer == other.issuer)

assertMsg

"Merge failed: owner does not match"

(owner == other.owner)

assertMsg

"Merge failed: symbol does not match"

(symbol == other.symbol)

archive otherCid

create this with

quantity = quantity + other.quantity

The return function used in Split is available in any Action context. The result of return x is a no-op containing the value x. It has an alias pure, indicating that it’s a pure value, as opposed to a value with side-effects. The return name makes sense when it’s used as the last statement in a do block as its argument is indeed the “return”-value of the do block in that case.

Taking transaction composition a step further, the Trade_Settle choice on Trade composes two exercise actions:

Trade_Settle

: (ContractId Asset, ContractId Asset)

with

quoteAssetCid : ContractId Asset

baseApprovalCid : ContractId TransferApproval

do

fetchedBaseAsset <- fetch baseAssetCid

assertMsg

"Base asset mismatch"

(baseAsset == fetchedBaseAsset with

observers = baseAsset.observers)

fetchedQuoteAsset <- fetch quoteAssetCid

assertMsg

"Quote asset mismatch"

(quoteAsset == fetchedQuoteAsset with

observers = quoteAsset.observers)

transferredBaseCid <- exercise

baseApprovalCid TransferApproval_Transfer with

assetCid = baseAssetCid

transferredQuoteCid <- exercise

quoteApprovalCid TransferApproval_Transfer with

assetCid = quoteAssetCid

return (transferredBaseCid, transferredQuoteCid)

The resulting transaction, with its two nested levels of consequences, can be seen in the test_trade scenario in Test.Intro.Asset.Trade:

TX #15 1970-01-01T00:00:00Z (Test.Intro.Asset.Trade:77:23)

#15:0

│ known to (since): 'Alice' (#15), 'Bob' (#15)

└─> 'Bob' exercises Trade_Settle on #13:1 (Intro.Asset.Trade:Trade)

with

quoteAssetCid = #10:1; baseApprovalCid = #14:2

children:

#15:1

│ known to (since): 'Alice' (#15), 'Bob' (#15)

└─> fetch #11:1 (Intro.Asset:Asset)

#15:2

│ known to (since): 'Alice' (#15), 'Bob' (#15)

└─> fetch #10:1 (Intro.Asset:Asset)

#15:3

│ known to (since): 'USD_Bank' (#15), 'Bob' (#15), 'Alice' (#15)

└─> 'Alice',

'Bob' exercises TransferApproval_Transfer on #14:2 (Intro.Asset:TransferApproval)

with

assetCid = #11:1

children:

#15:4

│ known to (since): 'USD_Bank' (#15), 'Bob' (#15), 'Alice' (#15)

└─> fetch #11:1 (Intro.Asset:Asset)

#15:5

│ known to (since): 'Alice' (#15), 'USD_Bank' (#15), 'Bob' (#15)

└─> 'Alice', 'USD_Bank' exercises Archive on #11:1 (Intro.Asset:Asset)

#15:6

│ referenced by #17:0

│ known to (since): 'Bob' (#15), 'USD_Bank' (#15), 'Alice' (#15)

└─> create Intro.Asset:Asset

with

issuer = 'USD_Bank'; owner = 'Bob'; symbol = "USD"; quantity = 100.0; observers = []

#15:7

│ known to (since): 'EUR_Bank' (#15), 'Alice' (#15), 'Bob' (#15)

└─> 'Bob',

'Alice' exercises TransferApproval_Transfer on #12:1 (Intro.Asset:TransferApproval)

with

assetCid = #10:1

children:

#15:8

│ known to (since): 'EUR_Bank' (#15), 'Alice' (#15), 'Bob' (#15)

└─> fetch #10:1 (Intro.Asset:Asset)

#15:9

│ known to (since): 'Bob' (#15), 'EUR_Bank' (#15), 'Alice' (#15)

└─> 'Bob', 'EUR_Bank' exercises Archive on #10:1 (Intro.Asset:Asset)

#15:10

│ referenced by #16:0

│ known to (since): 'Alice' (#15), 'EUR_Bank' (#15), 'Bob' (#15)

└─> create Intro.Asset:Asset

with

issuer = 'EUR_Bank'; owner = 'Alice'; symbol = "EUR"; quantity = 90.0; observers = []

Similar to choices, you can see how the scenarios in this project are built up from each other:

test_issuance = scenario do

setupResult@(alice, bob, bank, aha, ahb) <- setupRoles

assetCid <- submit bank do

exercise aha Issue_Asset

with

symbol = "USD"

quantity = 100.0

submit bank do

asset <- fetch assetCid

assert (asset == Asset with

issuer = bank

owner = alice

symbol = "USD"

quantity = 100.0

observers = []

)

return (setupResult, assetCid)

In the above, the test_issuance scenario in Test.Intro.Asset.Role uses the output of the setupRoles scenario in the same module.

The same line shows a new kind of pattern matching. Rather than writing setupResults <- setupRoles and then accessing the components of setupResults using _1, _2, etc., you can give them names. It’s equivalent to writing

setupResults <- setupRoles

case setupResults of

(alice, bob, bank, aha, ahb) -> ...

Just writing (alice, bob, bank, aha, ahb) <- setupRoles would also be legal, but setupResults is used in the return value of test_issuance so it makes sense to give it a name, too. The notation with @ allows you to give both the whole value as well as its constituents names in one go.

DAML’s execution model¶

DAML’s execution model is fairly easy to understand, but has some important consequences. You can imagine the life of a transaction as follows:

- A party submits a transaction. Remember, a transaction is just a list of actions.

- The transaction is interpreted, meaning the

Updatecorresponding to each action is evaluated in the context of the ledger to calculate all consequences, including transitive ones (consequences of consequences, etc.). - The views of the transaction that parties get to see (see Privacy) are calculated in a process called blinding, or projecting.

- The blinded views are distributed to the parties.

- The transaction is validated based on the blinded views and a consensus protocol depending on the underlying infrastructure.

- If validation succeeds, the transaction is committed.

The first important consequence of the above is that all transactions are committed atomically. Either a transaction is committed as a whole and for all participants, or it fails.

That’s important in the context of the Trade_Settle choice shown above. The choice transfers a baseAsset one way and a quoteAsset the other way. Thanks to transaction atomicity, there is no chance that either party is left out of pocket.

The second consequence, due to 2., is that the submitter of a transaction knows all consequences of their submitted transaction – there are no surprises in DAML. However, it also means that the submitter must have all the information to interpret the transaction.

That’s also important in the context of Trade. In order to allow Bob to interpret a transaction that transfers Alice’s cash to Bob, Bob needs to know both about Alice’s Asset contract, as well as about some way for Alice to accept a transfer – remember, accepting a transfer needs the authority of issuer in this example.

Observers¶

Observers are DAML’s mechanism to disclose contracts to other parties. They are declared just like signatories, but using the observer keyword, as shown in the Asset template:

template Asset

with

issuer : Party

owner : Party

symbol : Text

quantity : Decimal

observers : [Party]

where

signatory issuer, owner

ensure quantity > 0.0

observer observers

The Asset template also gives the owner a choice to set the observers, and you can see how Alice uses it to show her Asset to Bob just before proposing the trade. You can try out what happens if she didn’t do that by removing that transaction.

usdCid <- submit alice do

exercise usdCid SetObservers with

newObservers = [bob]

Observers have guarantees in DAML. In particular, they are guaranteed to see actions that create and archive the contract on which they are an observer.

Since observers are calculated from the arguments of the contract, they always know about each other. That’s why, rather than adding Bob as an observer on Alice’s AssetHolder contract, and using that to authorize the transfer in Trade_Settle, Alice creates a one-time authorization in the form of a TransferAuthorization. If Alice had lots of counterparties, she would otherwise end up leaking them to each other.

Controllers declared via the controller cs can syntax are automatically made observers. Controllers declared in the choice syntax are not, as they can only be calculated at the point in time when the choice arguments are known.

Privacy¶

DAML’s privacy model is based on two principles:

- Parties see those actions that they have a stake in.

- Every party that sees an action sees its (transitive) consequences.

Item 2. is necessary to ensure that every party can independently verify the validity of every transaction they see.

A party has a stake in an action if

- they are a required authorizer of it

- they are a signatory of the contract on which the action is performed

- they are an observer on the contract, and the action creates or archives it

What does that mean for the exercise tradeCid Trade_Settle action from test_trade?

Alice is the signatory of tradeCid and Bob a required authorizer of the Trade_Settled action, so both of them see it. According to rule 2. above, that means they get to see everything in the transaction.

The consequences contain, next to some fetch actions, two exercise actions of the choice TransferApproval_Transfer.

Each of the two involved TransferApproval contracts is signed by a different issuer, which see the action on “their” contract. So the EUR_Bank sees the TransferApproval_Transfer action for the EUR Asset and the USD_Bank sees the TransferApproval_Transfer action for the USD Asset.

Some DAML ledgers, like the scenario runner and the Sandbox, work on the principle of “data minimization”, meaning nothing more than the above information is distributed. That is, the “projection” of the overall transaction that gets distributed to EUR_Bank in step 4 of DAML’s execution model would consist only of the TransferApproval_Transfer and its consequences.

Other implementations, in particular those on public blockchains, may have weaker privacy constraints.

Divulgence¶

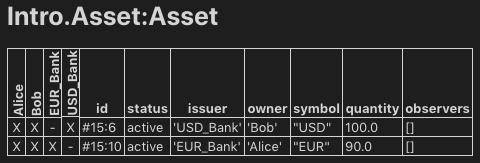

Note that principle 2. of the privacy model means that sometimes parties see contracts that they are not signatories or observers on. If you look at the final ledger state of the test_trade scenario, for example, you may notice that both Alice and Bob now see both assets, as indicated by the Xs in their respective columns:

This is because the create action of these contracts are in the transitive consequences of the Trade_Settle action both of them have a stake in. This kind of disclosure is often called “divulgence” and needs to be considered when designing DAML models for privacy sensitive applications.