Locking by safekeeping¶

Safekeeping is a realistic way to model locking as it is a common practice in many industries. For example, during a real estate transaction, purchase funds are transferred to the sellers lawyer’s escrow account after the contract is signed and before closing. To understand its implementation, review the original Coin template first.

template Coin

with

owner: Party

issuer: Party

amount: Decimal

delegates : [Party]

where

signatory issuer, owner

observer delegates

controller owner can

Transfer : ContractId TransferProposal

with newOwner: Party

do

create TransferProposal

with coin=this; newOwner

--a coin can only be archived by the issuer under the condition that the issuer is the owner of the coin. This ensures the issuer cannot archive coins at will.

controller issuer can

Archives

: ()

do assert (issuer == owner)

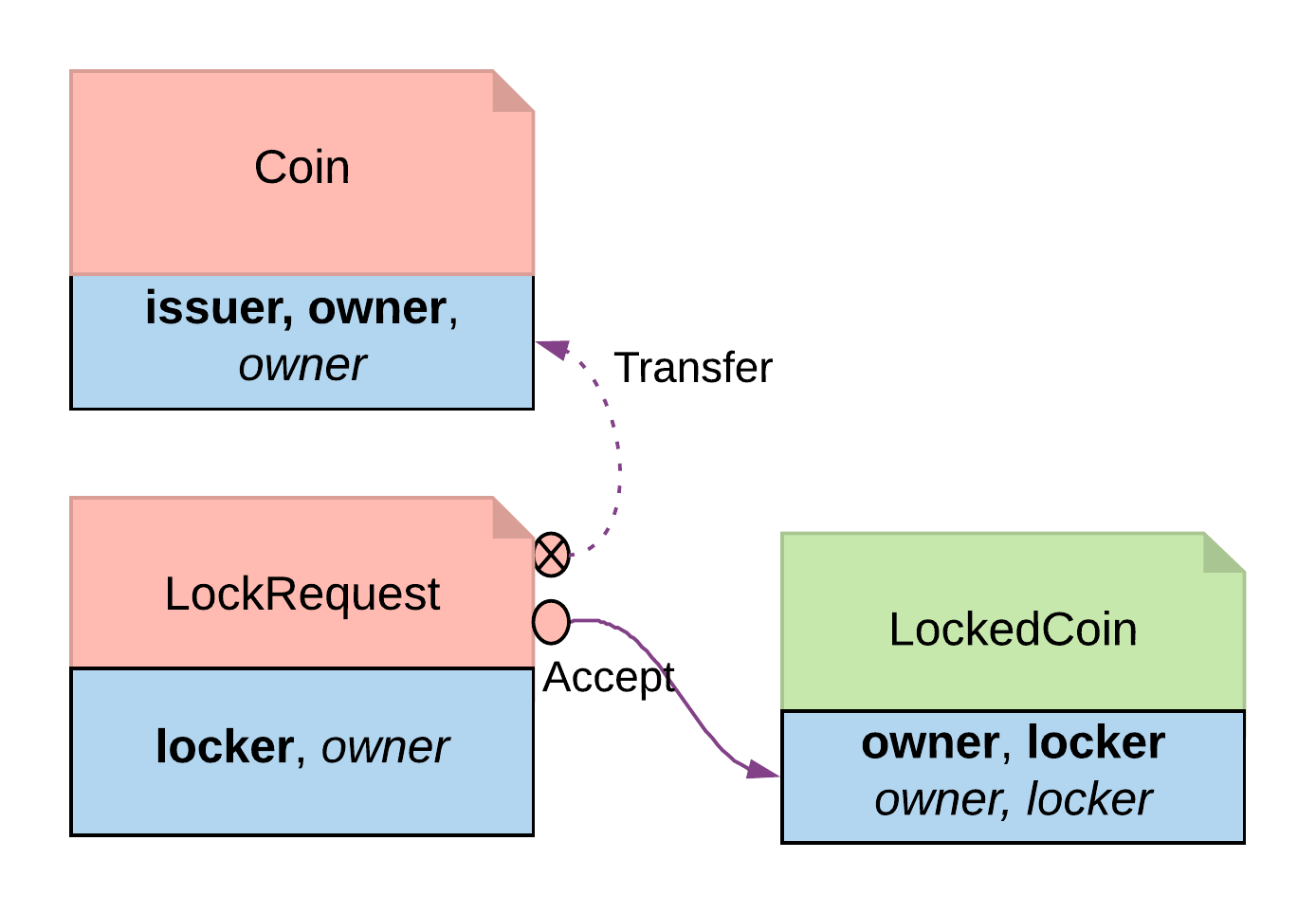

There is no need to make a change to the original contract. With two additional contracts, we can transfer the Coin ownership to a locker party.

- Introduce a separate contract template LockRequest with the following features:

- LockRequest has a locker party as the single signatory, allowing the locker party to unilaterally initiate the process and specify locking terms.

- Once owner exercises Accept on the lock request, the ownership of coin is transferred to the locker.

- The Accept choice also creates a LockedCoinV2 that represents Coin in locked state.

template LockRequest

with

locker: Party

maturity: Time

coin: Coin

where

signatory locker

controller coin.owner can

Accept : LockResult

with coinCid : ContractId Coin

do

inputCoin <- fetch coinCid

assert (inputCoin == coin)

tpCid <- exercise coinCid Transfer with newOwner = locker

coinCid <- exercise tpCid AcceptTransfer

lockCid <- create LockedCoinV2 with locker; maturity; coin

return LockResult {coinCid; lockCid}

- LockedCoinV2 represents Coin in the locked state. It is fairly similar to the LockedCoin described in Consuming choice. The additional logic is to transfer ownership from the locker back to the owner when Unlock or Clawback is called.

template LockedCoinV2

with

coin: Coin

maturity: Time

locker: Party

where

signatory locker, coin.owner

controller locker can

UnlockV2

: ContractId Coin

with coinCid : ContractId Coin

do

inputCoin <- fetch coinCid

assert (inputCoin.owner == locker)

tpCid <- exercise coinCid Transfer with newOwner = coin.owner

exercise tpCid AcceptTransfer

controller coin.owner can

ClawbackV2

: ContractId Coin

with coinCid : ContractId Coin

do

currTime <- getTime

assert (currTime >= maturity)

inputCoin <- fetch coinCid

assert (inputCoin == coin with owner=locker)

tpCid <- exercise coinCid Transfer with newOwner = coin.owner

exercise tpCid AcceptTransfer

Locking By Safekeeping Diagram

Trade-offs¶

Ownership transfer may give the locking party too much access on the locked asset. A rogue lawyer could run away with the funds. In a similar fashion, a malicious locker party could introduce code to transfer assets away while they are under their ownership.