Settlement¶

Settlement refers to the execution of holding transfers originating from a financial transaction.

Daml Finance provides facilities to execute these transfers atomically (i.e., within the same Daml

transaction). Interfaces are defined in the Daml.Finance.Interface.Settlement.V4 package, whereas

implementations are provided in the Daml.Finance.Settlement.V4 package.

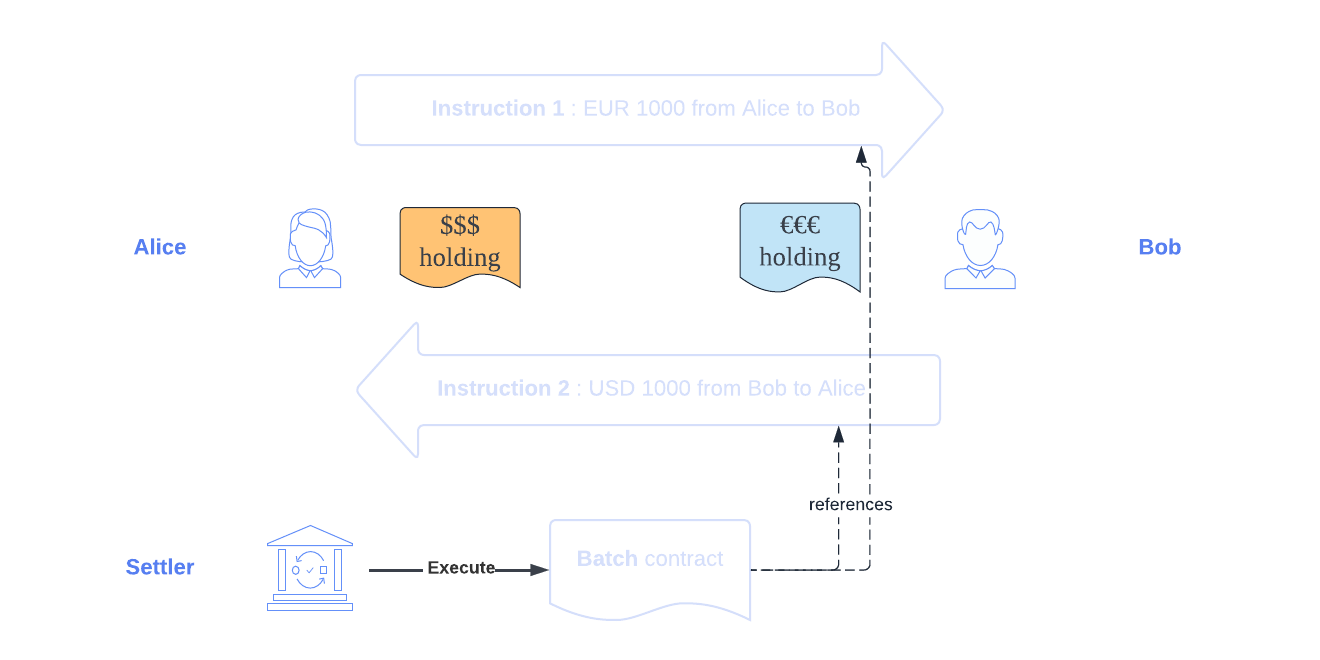

In this section, we first illustrate the settlement workflow with the help of an example FX transaction, where Alice transfers a EUR-denominated holding to Bob, in exchange for a USD-denominated holding of the same amount.

We then delve into the details of each of the settlement components.

Workflow¶

Our initial state looks as follows:

- Alice owns a holding on a

EURinstrument, for an amount of1000 - Bob owns a holding on a

USDinstrument, for an amount of1000

These holdings are generally held at different custodians.

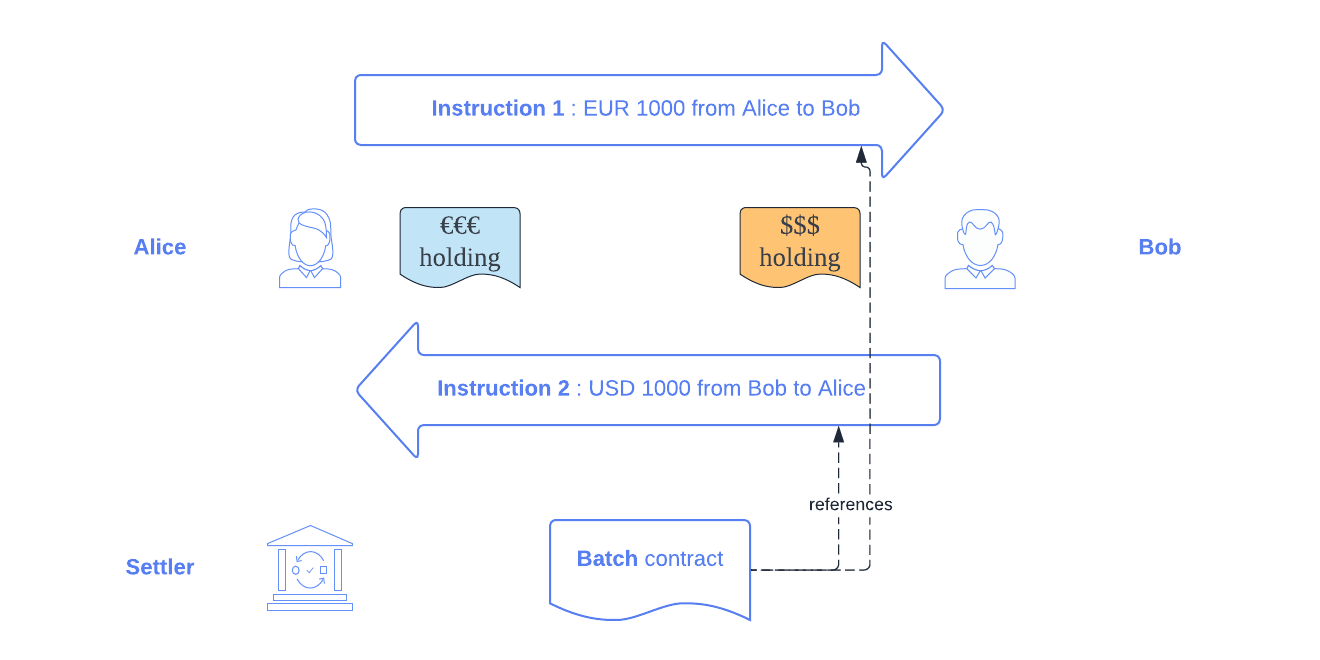

Instruct¶

Alice and Bob want to exchange their holdings and agree to enter into the transaction by being signatories on a transaction contract. Settlement can then be instructed which results in 3 contract instances being created:

- an Instruction to transfer EUR 1000 from Alice to Bob

- an Instruction to transfer USD 1000 from Bob to Alice

- a Batch used to execute the above Instructions

Each instruction defines who is the sender, who is the receiver, and what should be transferred (instrument and amount) at which custodian.

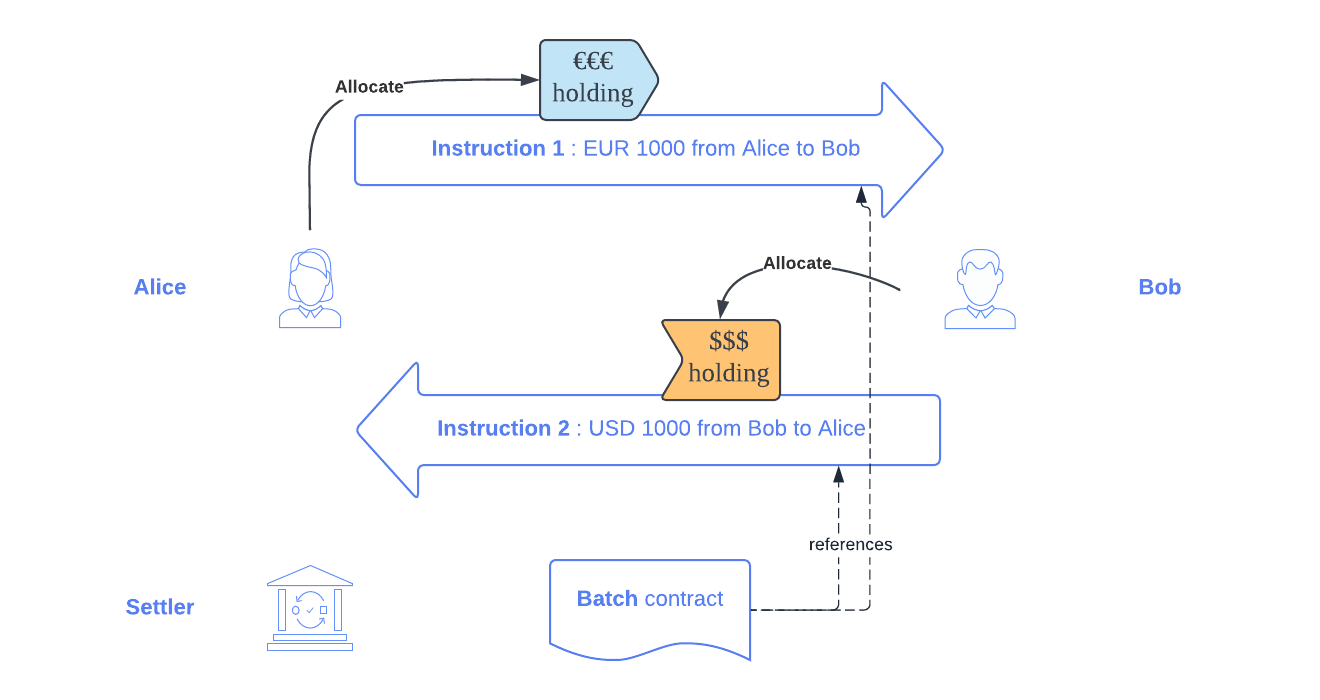

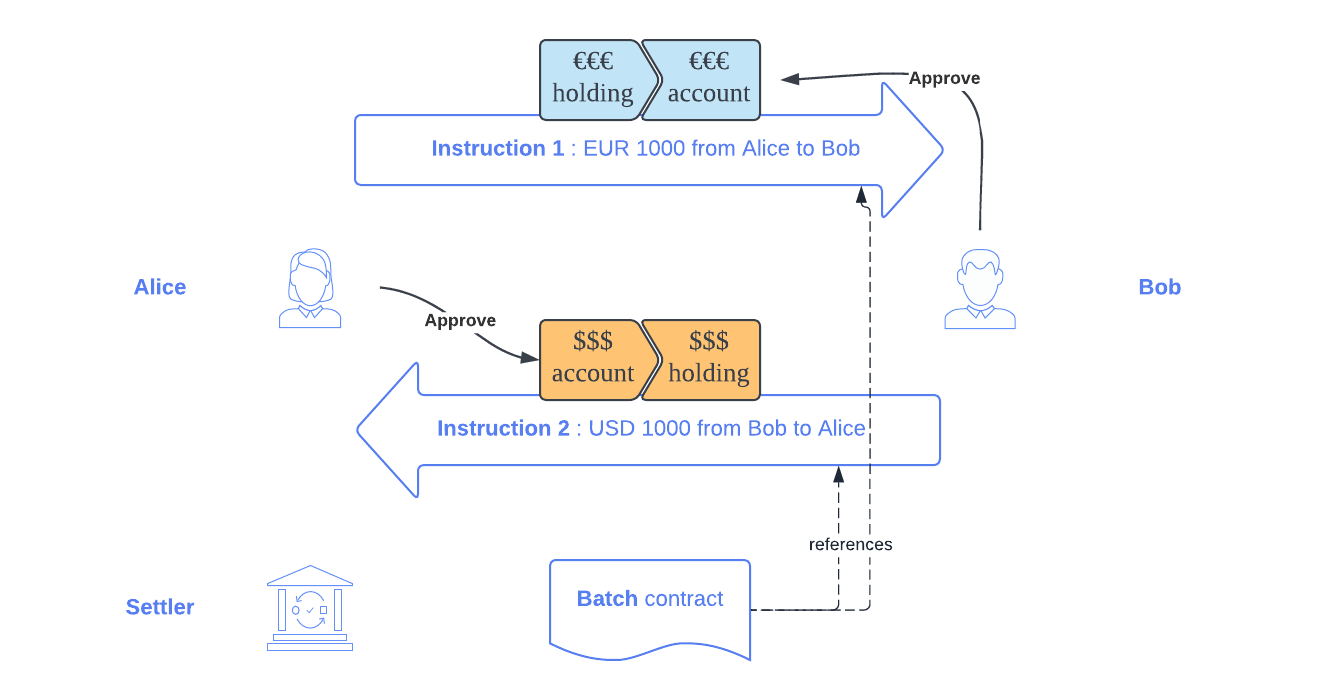

Allocate and Approve¶

In order to execute the FX transaction, we first need to:

- allocate, i.e., specify which holding should be used

- approve, i.e., specify to which account the asset should be transferred

Allocation and approval is required for each Instruction.

Alice allocates the instruction where she is the sender by pledging her holding. Bob does the same on the instruction where he is the sender.

Each receiver can then specify to which account the holding should be sent by approving the corresponding instruction.

Execute¶

Once both instructions are allocated and approved, a Settler party uses the Batch contract to execute them and finalize settlement in one atomic transaction.

The instructions and the batch are archived following a successful execution.

Remarks¶

There are some assumptions that need to hold in order for the settlement to work in practice:

- Bob needs to have an account at the custodian where Alice’s holding is held and vice versa (for an example with intermediaries, see Route provider below.

- Both holdings need to be Transferable

- The transfer must be fully authorized (i.e., the parties allocating and approving an instruction must be the controllers of outgoing and incoming transfers of the corresponding accounts, respectively)

Also, note that the allocation and approval steps can happen in any order.

The components in detail¶

Route provider¶

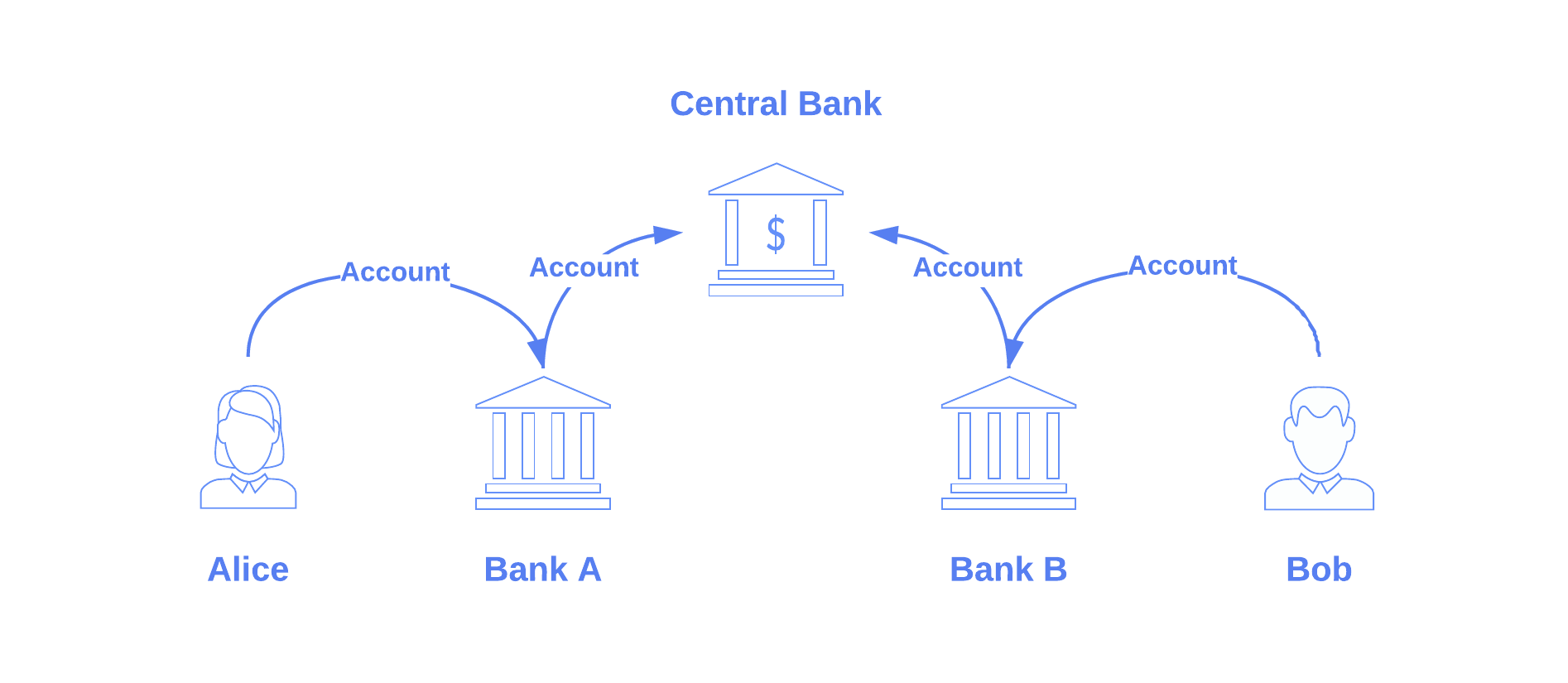

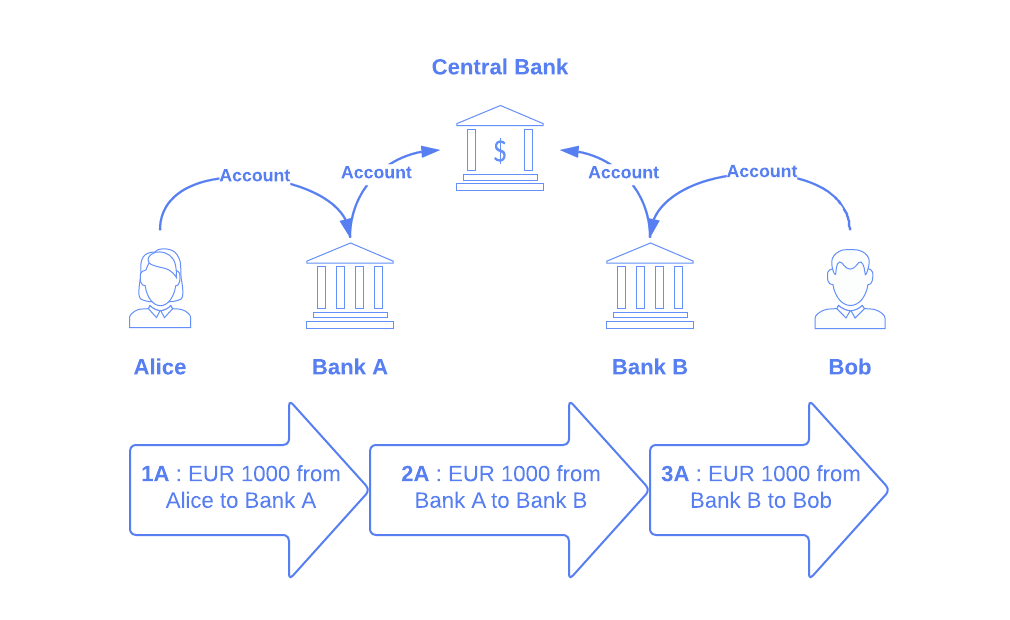

When a transfer requires intermediaries to be involved, the role of a Route Provider becomes important. Let us assume, for instance, that Alice’s EUR holding in the example above is held at Bank A, whereas Bob has a EUR account at Bank B. Bank A and Bank B both have accounts at the Central Bank.

In this case, a direct holding transfer from Alice to Bob cannot generally be instructed. The original Instruction between Alice and Bob needs to be replaced by three separate Instructions:

- 1A: Alice sends EUR 1000 (held at Bank A) to Bank A

- 1B: Bank A sends EUR 1000 (held at the Central Bank) to Bank B.

- 1C: Bank B credits EUR 1000 to Bob’s account (held at Bank B)

We refer to this scenario as settlement with intermediaries, or just intermediated settlement.

The Route Provider is used to discover a settlement route, i.e., routed steps, for each settlement step.

Settlement factory¶

The Settlement Factory is used to instruct settlement, i.e., create the Batch contract and the settlement Instructions, from routed steps, so that they can be allocated and approved by the respective parties.

Instruction¶

The Instruction is

used to settle a single holding transfer at a specific custodian, once it is allocated and

approved.

In the Allocation step, the sender acknowledges the transfer and determines how to send the holding. This is usually done by allocating with a Pledge of the sender’s existing holding (which has the correct instrument quantity) at the custodian. When the sender is also the custodian, the instruction can be allocated with CreditReceiver. In this case, a new holding is directly credited into the receiver’s account.

In the Approval step, the receiver acknowledges the transfer and determines how to receive the holding. This is usually done by approving with TakeDelivery to one of the receiver’s accounts at the custodian. When the receiver is also the incoming holding’s custodian, the instruction can be approved with DebitSender. In this case, the holding is directly debited from the sender’s account. A holding owned by the custodian at the custodian has no economical value, it is a liability against themselves and can therefore be archived without consequence.

To clarify these concepts, here is how the 3 instructions in the intermediated example above would be allocated / approved.

| Instruction | Allocation | Approval |

|---|---|---|

| 1A : EUR 1000 from Alice to Bank A @ Bank A | Alice pledges her holding | Bank A approves with DebitSender |

| 1B : EUR 1000 from Bank A to Bank B @ Central Bank | Bank A pledges its holding | Bank B takes delivery to its account |

| 1C : EUR 1000 from Bank B to Bob @ Bank B | Bank B allocates with CreditReceiver | Bob takes delivery to his account |

Finally, the Instruction supports two additional settlement modes:

- Any instruction can settle off-ledger (if the stakeholders agree to do so). For this to work, we require the custodian and the sender to jointly allocate the instruction with a SettleOffledger, and the custodian and the receiver to jointly approve the instruction with a SettleOffledgerAcknowledge.

- A special case occurs when a transfer happens via an intermediary at the same custodian, i.e., we have 2 instructions having the same custodian and instrument quantity (in a batch), and the receiver of the first instruction is the same as the sender of the second instruction. In this case, we allow the holding received from the first instruction to be passed through to settle the second instruction, i.e., without using any pre-existing holding of the intermediary. For this to work, the first instruction is approved with PassThroughTo (i.e., pass through to the second instruction), and the second instruction is allocated with PassThroughFrom (i.e., pass through from the first instruction). An intermediary account used for the passthrough is thereby also to be specified.

Batch¶

The Batch is used to execute a set of instructions atomically. Execution will fail if any of the Instructions is not fully allocated / approved, or if the transfer is unsuccessful.

Settlement Time¶

The settlement time for financial transactions can vary based on the market and the type of securities involved. Typically, settlement periods are denoted as T+1, T+2, or T+3, indicating the transaction date plus one, two, or three business days, respectively. Some markets may also offer real-time settlement options. It’s also common for certain trades between parties to have unique, mutually agreed-upon settlement periods.

The Batch and Instruction implementations are designed to allow the optional setting of a preferred settlement time, without any mechanisms that enforce a specific settlement time. This design choice offers several advantages:

- Settlement Time Flexibility: The Settler party has the discretion to decide or defer the actual settlement time. This includes the ability to settle transactions after the designated settlement time, which can be particularly useful in resolving any off-ledger disputes.

- Avoidance of Early Settlement: Parties involved in sending or receiving a holding may opt to delay their allocation or approval of an instruction until just prior to the settlement time. This strategy prevents the Batch from settling prematurely.

- Handling of Late Settlements: To address cases where parties fail to settle by the desired time, we propose using a separate custom contract instance. This contact could facilitate the rolling of a Batch (along with its Instructions) into a subsequent settlement cycle if the initial settlement period lapses. Additionally, the contract could allow for imposing penalties on parties that fail to allocate or approve the transaction in a timely manner.

For scenarios requiring a more stringent settlement process, customers are welcome to provide their own implementation. This custom implementation can include specific checks and controls tailored to their particular needs and requirements.

Remarks and further references¶

The settlement concepts are also explored in the Settlement tutorial.