Contingent Claims¶

Introduction¶

Contingent Claims is a library for modeling financial instruments in Daml. An instrument is represented by a tree of Claims, which describe future contractual events (cashflows and other effects) between two parties as well as the conditions under which these contractual events occur.

The library offers lifecycling capabilities, as well as an (experimental) valuation semantics to map a claim to a mathematical expression that can be used for no-arbitrage pricing.

Examples of how to create and lifecycle contracts using Contingent Claims can be found in the Payoff Modeling tutorial.

In the following we present a user guide for getting started with Contingent Claims instrument modeling. It is meant to teach the basics of the framework, but does not cover every aspect. The work is based on the papers [Cit1] and [Cit2], and we recommend that you refer to these for an in-depth understanding of how it works.

The Model¶

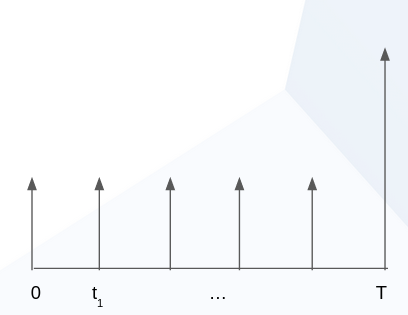

The approach taken in the papers is to model financial instruments by their cashflows. This should be familiar to anyone having taken a course in corporate finance or valuation. Let’s start with an example:

The picture above represents the cashflows of a fixed-rate bond. Or alternatively, you can think of it as a mortgage, from the point of view of the bank: there are interest payments at regular intervals (the small arrows), and a single repayment of the loan at maturity (the big arrow on the right). So how do we go about modelling this?

We use the following data type, slightly simplified from Claim:

data Claim a

= zero

| one a

| give (Claim a)

| and with lhs: Claim a, rhs: Claim a

| or with lhs: Claim a, rhs: Claim a

| scale with k: Date -> Decimal, claim: Claim a

| when with predicate: Date -> Bool, claim: Claim a

| anytime with predicate : Date -> Bool, claim: Claim a

| until with predicate : Date -> Bool, claim: Claim a

There are a couple of things to consider.

First note that the constructors of this data type create a tree structure. The leaf constructors

are zero and one a, and the other constructors create branches (observe they call

Claim a recursively). The constructors are just functions, and can be combined to produce

complex effects. For example, to represent the above bond, we could write

the following:

when (time == t_0) (scale (pure coupon) (one “USD”)) `and` ...

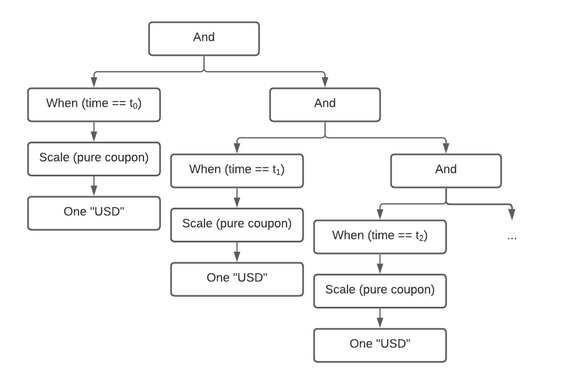

Let’s look at the constructors used in the above expression in more detail:

one "USD"means that the acquirer of the contract receives one unit of the asset, parametrised bya, immediately. In this case we use a 3-letter ISO code to represent a currency, but you can use your own type to represent any asset.scale (pure coupon)modifies the magnitude of the arrow in the diagram. For example, in the diagram, the big arrow would have a distinct scale factor from the small arrows. In our example, the scale factor is constant:pure coupon = const coupon, however, it’s possible to have a scale factor that depends on an unobserved value, such as a stock price, the weather, or any other measurable quantity.when (time == t_0)tells us where along the x-axis the arrow is placed, i.e., it modifies the point in time when the claim is acquired. The convention is that this must be the first instant that the predicate (time == t_0in this case) is true. In our example it is a point, but again, we could have used an expression with an unknown quantity, for examplespotPrice > pure k, and it would trigger the first instant that the expression becomes true.andis used to chain multiple expressions together. Remember that in thedatadefinition above, each constructor is a function:and : Claim a -> Claim a -> Claim a. We use the Daml backtick syntax to writeandas an infix operator, for legibility.

Additionally, there are several constructors which were not used in the above example:

zero, used to indicate an absence of obligations. While it may not make sense to create azeroclaim, it could, for example, result from applying a function on a tree of claims.givewould flip the direction of the arrows in our diagram. For example, in a swap we could usegiveto distinguish the received/paid legs.oris used to give the bearer the right to choose between two different claims. This is typically used for options.anytimeis likewhen, except it allows the bearer to choose (vs. no choice) acquisition within a region (or timeframe), vs. a specific point in time.untilis used to adjust the expiration (horizon in [Cit1]) of a claim. Typically, it is used withanytimeto limit aforesaid acquisition region.

The tree produced by our expression (corresponding to the cashflow figure above) looks like this:

Composition and Extensibility¶

Although we could model every subsequent arrow the way we did the first one, as good programmers we wish to avoid repeating ourselves. Hence, we could write functions to re-use subexpressions of the tree. But which parts should we factor out? It turns out that Finance 101 comes to the rescue again. Fixed income practitioners will typically model a fixed-rate bond as a sum of zero-coupon bonds. That’s how we model them in Claims.Util.Builders. Below are slightly simplified versions:

zcb maturity principal asset =

when (time == maturity) (scale (O.pure principal) (one asset))

Here we’ve just wrapped our expression from the previous section in a function zcb, that we can

reuse to build a fixed-rate bond:

fixed : Decimal -> Decimal -> a -> [Date] -> Claim a

fixed principal coupon asset [] = zero

fixed principal coupon asset [maturity] =

zcb maturity coupon asset `and` zcb maturity principal asset

fixed principal coupon asset (t :: ts) =

zcb t coupon asset `and` fixed principal coupon asset ts

We define the fixed rate bond by induction, iterating over a list of dates [t], and producing

multiple zero-coupon bonds zcb combined together with and:

- The first definition covers the trivial case where we pass an empty list of dates.

- The second definition handles the base case, at maturity: we create both a coupon (interest) payment, and the principal payment.

- The third definition is the induction step; it peels the first element off the list, and calls itself recursively on the tail of the list, until it reaches the base case at maturity.

This re-use of code is prevalent throughout the library. It’s great as it mirrors how instruments are defined in the industry. Let’s look at yet another example, a fixed vs floating USD/EUR swap.

type Ccy = Text

usdVsEur : [Date] -> Claim Ccy

usdVsEur =

fixed 100.0 0.1 "USD" `swap` floating (spot "EURUSD" * pure 100.0) (spot "EURUSD") "EUR"

We define it in terms of its two legs, fixed and floating, which themselves are functions.

We use swap in infix form, and partially apply it - it takes a final [Date] argument which

we omit, hence the resulting signature [Date] -> Claim Ccy.

As you can see, not only is this approach highly composable, but it also mirrors the way derivative instruments are modelled in finance.

Another major advantage of this approach is its extensibility. Unlike a traditional approach, where

we might in an object-oriented language represent different instruments as classes, in the cashflow

approach, we do not need to enumerate possible asset classes/instruments a priori. This is

especially relevant in a distributed setting, where parties must execute the same code, i.e., have

the same *.dars on their ledger to interact. In other words, party A can issue a new

instrument, or even write a new combinator function that is in a private *.dar, while being able

to trade with party B, who has no knowledge of this new *.dar.

Concerning Type Parameters¶

The curious reader may have noticed that the signature we gave for data Claim is not quite what

is in the library, where we have data Claim t x a o. In our examples, we have specialised this

to type Claim' t x a o = Claim Date Decimal a a. Parameterising these variables allows us to

reason about Assets and Observations that appear inClaims as function-like

objects. The main use of this is to create claims with ‘placeholders’ for actual parameters, that

can later be ‘filled in’ by mapping over them (mapParams).

The Time Parameter¶

t is used to represent the first input argument to an Observation, and above we used

Date for this purpose. One reason this has been left parametrised is to be able to distinguish

different calendar and day count conventions at the type level. This is quite a technical topic, but

it suffices to know that for financial calculations, interest is not always accrued the same way,

nor is settlement possible every day, as this depends on local jurisdictions or market conventions.

Having different types makes this explicit at the instrument level.

Another use for this is expressing time as an ordinal values, representing e.g. days from issue.

Such a Claim can be used repeatedly to represent instruments issued at different dates, but with

the same durations.

For example, consider a series of listed futures or options which are issued with quarterly/monthly

maturities - their duration is about the same, but they are issued on different dates.

The Asset Parameter¶

a, as we already explained, is the type used to represent assets in your application. Keeping

this generic means the library can be used with any asset representation. For example, you could use

one of the instrument implementations in Daml Finance, but are not forced to do so.

The Observation Parameter¶

o is the type used to represent Observations, which are time-dependent quantities that can

be observed at any given time (such as the “EURUSD” exchange rate in the example above).

The Value Parameter¶

x is the ‘output’ type of an Observation, but it can also serve as input when defining a

constant observation using, e.g., Observation.pure 10.08.

Lifecycling¶

So far we’ve learned how to model arbitrary financial instruments by representing them as trees of

cashflows. We’ve seen that these trees can be constructed using the type constructors of

data Claim, and that they can be factored into more complex building blocks using function

composition. But now that we have these trees, what can we do with them?

The original paper [Cit1] focuses on using these trees for valuing the instruments they represent, i.e., finding the ‘fair price’ that one should pay for these cashflows. Instead, we’ll focus here on a different use case: the lifecycling (aka safekeeping, processing corporate actions) of these instruments.

Let’s go back to our fixed-rate bond example, above. We want to process the coupon payments. There is a function in the Lifecycle module for doing exactly this:

type C t a o = Claim t Decimal a o

-- | Used to specify pending payments.

data Pending t a = Pending

with

t : t

-- ^ Payment time.

amount : Decimal

-- ^ Amount of asset to be paid.

asset : a

-- ^ Asset in which the payment is denominated.

deriving (Eq, Show)

-- | Returned from a `lifecycle` operation.

data Result t a o = Result

with

pending : [Pending t a]

-- ^ Payments requiring settlement.

remaining : C t a o

-- ^ The tree after lifecycled branches have been pruned.

deriving (Eq, Show)

-- | Collect claims falling due into a list, and return the tree with those nodes pruned.

-- `m` will typically be `Update`. It is parametrised so it can be run in a `Script`. The first

-- argument is used to lookup the value of any `Observables`. Returns the pruned tree + pending

-- settlements up to the provided market time.

lifecycle : (Ord t, Eq a, CanAbort m)

=> (o -> t -> m Decimal)

-- ^ Function to evaluate observables.

-> C t a o

-- ^ The input claim.

-> t

-- ^ The input claim's acquisition time.

-> t

-- ^ The current market time. This is the time up to which observations are known.

-> m (Result t a o)

This may look daunting, but let’s look at an example in ContingentClaims/Test/FinancialContract.daml to see this in action:

do

t <- toDateUTC <$> getTime

let

getSpotRate isin t = do

(_, Quote{close}) <- fetchByKey (isin, t, bearer)

pure close

lifecycleResult <- Lifecycle.lifecycle getSpotRate claims acquisitionTime t

The first argument to lifecycle, getSpotRate, is a function taking an ISIN (security) code, and

today’s date. All this does is fetch a contract from the ledger that is keyed by these two values,

and extract the price of the security.

The last two arguments are simply the claims we wish to process, and today’s date, evaluated using

getTime.

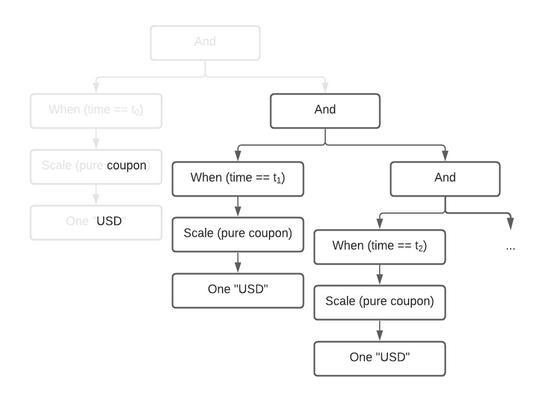

The return value, lifecycleResult, will contain both the remaining tree after lifecycling, and

any assets that need to be settled. In our running bond example, we would extract the coupon

from the first payment, and return it, along with the rest of the tree, after that branch has been

pruned (depicted greyed-out below):

You may wonder why we’ve separated the settlement procedure from the lifecycling function. The reason is that we can’t assume that settlement will happen on-chain; if it does, that is great, as we can embed this call into a template choice, and lifecycle and settle atomically. However, in the case where settlement must happen off-chain, there’s no way to to do this in one step. This design supports both choices.

Pricing (Experimental)¶

This is an experimental feature. Expect breaking changes.

The ContigentClaims.Valuation.Stochastic

module can be used for valuation. There is a fapf

function which is used to derive a fundamental asset pricing formula for an arbitrary Claim

tree. The resulting AST is represented by Expr, but can be rendered as XML/MathML with the

provided MathML.presentation function, for display in a web browser. See the Test/Pricing

module for examples. Here is a sample rendering of a margrabe option:

<math display="block"><msub><mi>USD</mi><mi>t</mi></msub><mo></mo><mo>𝔼</mo><mo></mo><mrow><mo fence="true">[</mo><mrow><mo fence="true">(</mo><msub><mo>I</mo><mrow><msub><mi>AMZN</mi><mi>T</mi></msub><mo>-</mo><msub><mi>APPL</mi><mi>T</mi></msub><mo>≤</mo><mn>0.0</mn></mrow></msub><mo></mo><mrow><mo fence="true">(</mo><msub><mi>AMZN</mi><mi>T</mi></msub><mo>-</mo><msub><mi>APPL</mi><mi>T</mi></msub><mo fence="true">)</mo></mrow><mo>+</mo><msub><mo>I</mo><mrow><mn>0.0</mn><mo>≤</mo><msub><mi>AMZN</mi><mi>T</mi></msub><mo>-</mo><msub><mi>APPL</mi><mi>T</mi></msub></mrow></msub><mo>×</mo><mn>0.0</mn><mo fence="true">)</mo></mrow><mo></mo><msup><mrow><msub><mi>USD</mi><mi>T</mi></msub></mrow><mrow><mo>-</mo><mn>1.0</mn></mrow></msup><mo>|</mo><msub><mo mathvariant="script">F</mo><mi>t</mi></msub><mo fence="true">]</mo></mrow></math>

You can cut-and-paste this into a web page in ‘developer mode’ in any modern browser.

References¶

| [Cit1] | (1, 2, 3) Jones, S. Peyton, Jean-Marc Eber, and Julian Seward. “Composing contracts: an adventure in financial engineering.” ACM SIG-PLAN Notices 35.9 (2000): 280-292. |

| [Cit2] | Jones, SL Peyton, and J. M. Eber. “How to write a financial contract”, volume “Fun Of Programming” of “Cornerstones of Computing.” (2005). |

The papers can be downloaded from Microsoft Research.